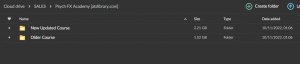

1st Course

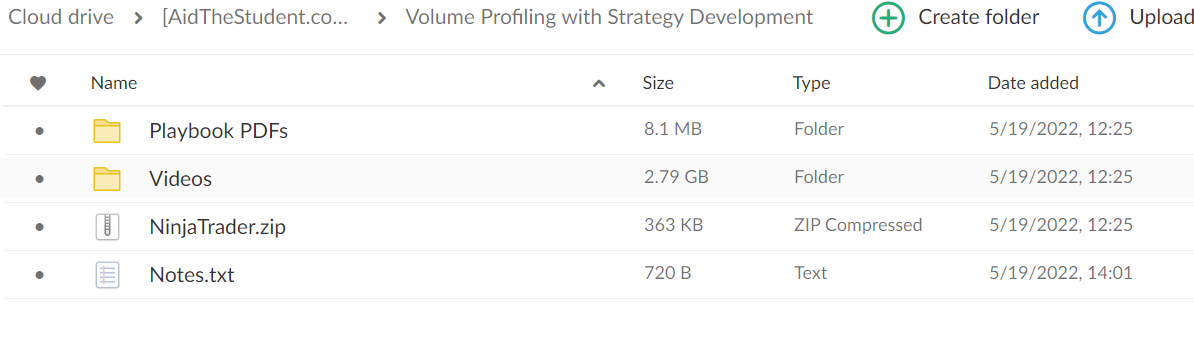

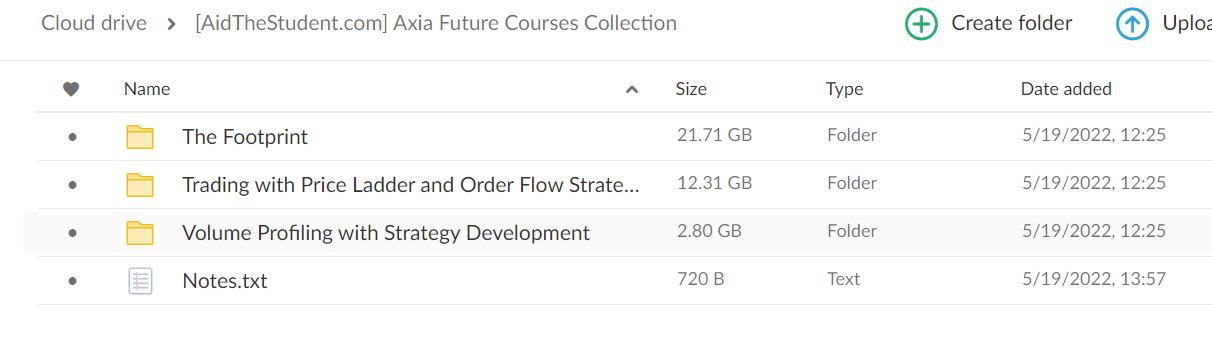

Volume Profiling with Strategy Development:

OVERVIEW

INTRODUCTION

| THE PLAYBOOK | |

| How to Download, Edit and Complete The Playbook | |

| FREE SIM TRADING PLATFORM | |

| How to Activate, Setup and Use the Free Sim Trading Platform | |

| MODULE 1 – THE APPRENTICESHIP | |

| PART 1 – What, How and Why of Volume Profiling | |

| PART 2 – Participants within the Auction Process | |

| PART 3 – Volume Profiling Elements | |

| PART 4 – Volume Profiling in Action | |

| MODULE 2 – THE PROFICIENCY | |

| PART 5 – Principles: Symmetry, Day Types, Price Behaviour and Trading Process | |

| PART 6 – Bracketing, Trending, Market Balance, Trade Location and Market Open Strategies | |

| PART 7 – Auction Identifiers, Point of Control, Anomalies and High/Low Volume Areas | |

| PART 8 – Control Identifiers, Profile Strategies and Volume Profiling Templating | |

| MODULE 3 – THE SPECIALIST | |

| PART 9 – Anomaly Volume Profiling Strategies | |

| PART 10 – Momentum Volume Profiling Strategies | |

| PART 11 – Trending Volume Profiling Strategies | |

| PART 12 – Reversal Volume Profiling Strategies | |

2nd Course

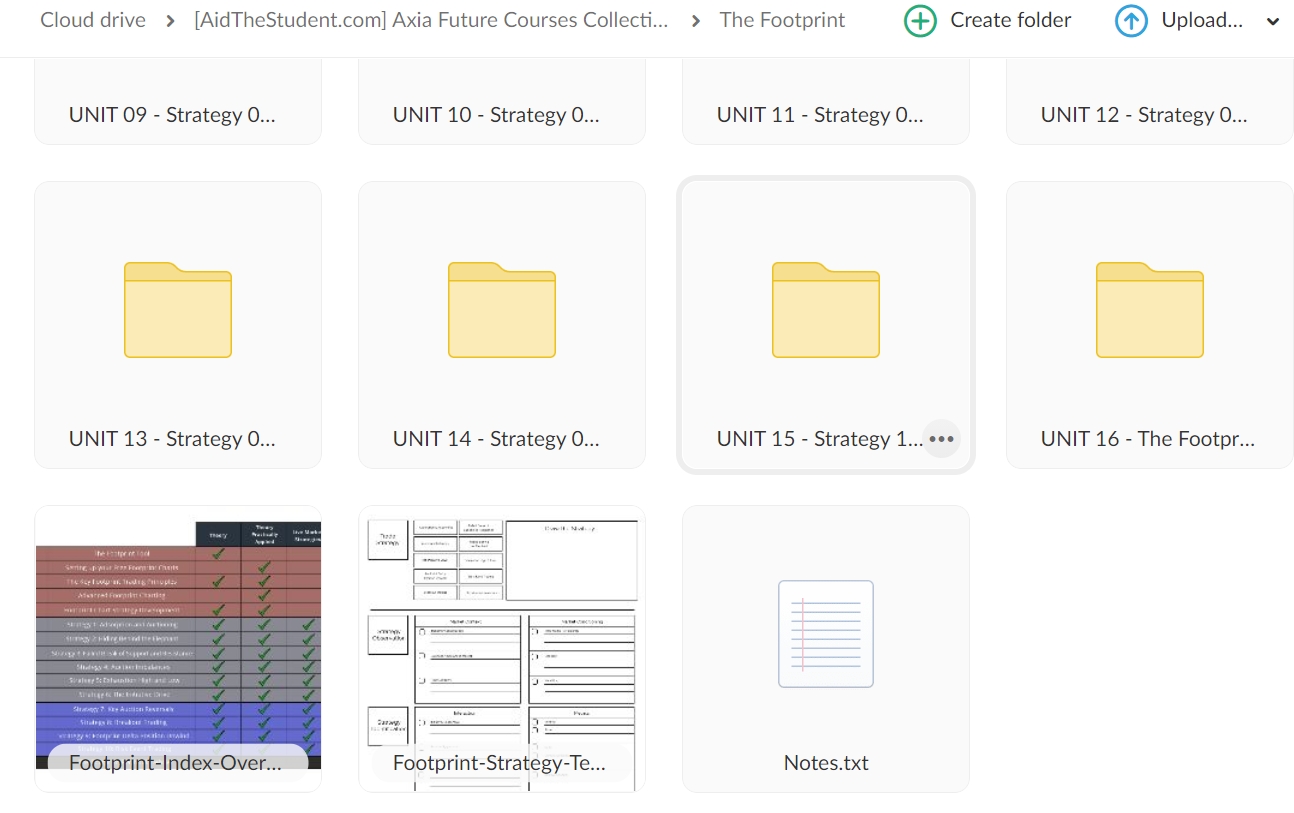

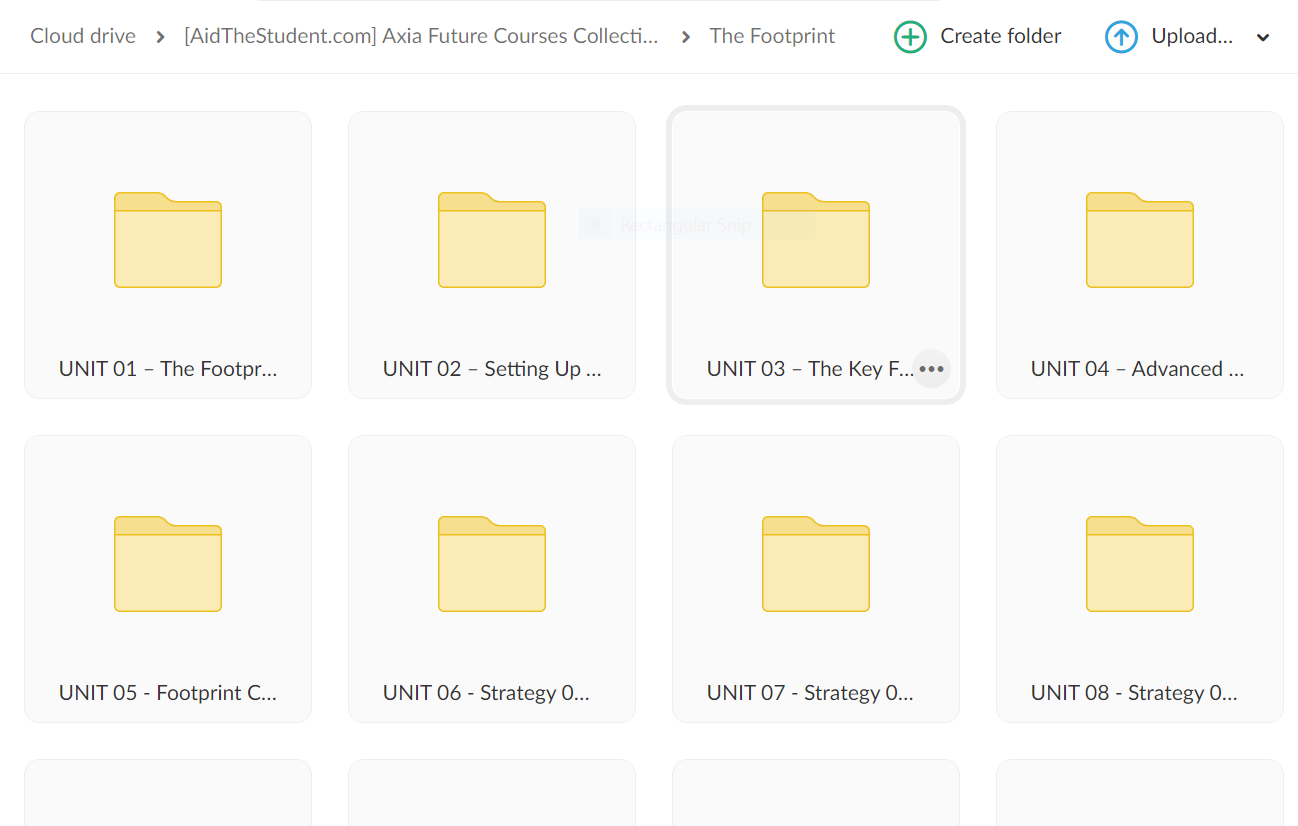

The Footprint Edge Course

| The Footprint 30-Day Challenge Calendar |

| The Footprint Index Overview |

| The Footprint Strategy Template |

| INTRODUCTION |

| UNIT 1 – The Footprint Tool |

| UNIT 2.1 – Setting up Your Free 30-day Footprint Charts (for Sierra Chart Users) |

| UNIT 2.2 – Setting up Your Footprint Charts (only for existing CQG Users) |

| UNIT 3 – The Key Footprint Trading Principles |

| UNIT 4 – Advanced Footprint Charting |

| UNIT 5 – Footprint Chart Strategy Development |

| INTERMEDIATE |

| UNIT 6 – Strategy 1: Absorption and Auctioning |

| UNIT 7 – Strategy 2: Hiding Behind the Elephant |

| UNIT 8 – Strategy 3: Failed Break of Support and Resistance |

| UNIT 9 – Strategy 4: Auction Imbalances |

| UNIT 10 – Strategy 5: Exhaustion High and Low |

| UNIT 11 – Strategy 6: The Initiative Drive |

| ADVANCED |

| UNIT 12 – Strategy 7: Key Auction Reversals |

| UNIT 13 – Strategy 8: Breakout Trading |

| UNIT 14 – Strategy 9: Footprint Delta Position Unwind |

| UNIT 15 – Strategy 10: Risk Event Trading |

| BONUS MATERIAL |

| UNIT 16 – The Footprint Playbook Debrief |

| Free Live Streaming Premium Membership |

| THE FOOTPRINT WORKSHOP |

| Part 1 – How to Setup, Interpret and Comprehend |

| Part 2 – Market Interaction and Scenario Analysis |

| Part 3 – Master Pattern Recognition |

3rd Course

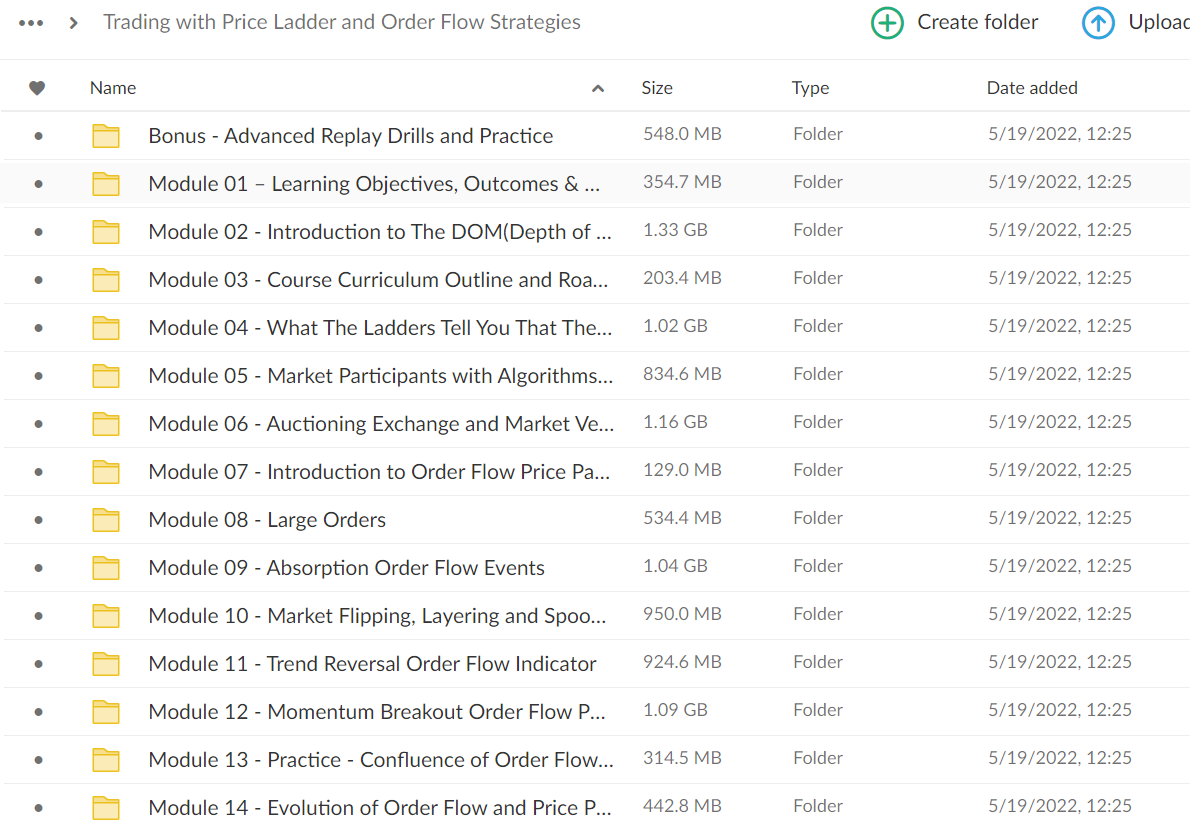

PRICE LADDER TRADER TRAINING AND ORDER FLOW STRATEGIES COURSE

Course Overview

The Price Ladder Trader Training and Order Flow Strategies course is a fully comprehensive, intensive and immersive price ladder training programme developed by the combined experience and strategies of our entire group of successful proprietary traders located in our London and Wroclaw/Poland Trading floors. The course is for both complete beginners as well as advanced order flow traders looking to increase their understanding of the DOM and cultivate more trading strategies in their arsenal. All the training on this course is also used in developing our successful graduates who are financially backed by our partner firm. At the end of this training, if you go through all the material and the practical drills and practices, you will develop an approach that you can commence utilising your own cognitive abilities in deploying and identifying order flow strategies in the market. This course is also the first of its kind in the world in that its material and drills are constantly updated, and the last bonus section includes the Live Recorded Execution and Analysis of not one of AXIA’s top price ladder traders but one of Europe’s Best.

Over 1.000 comments

Over 1.000 comments