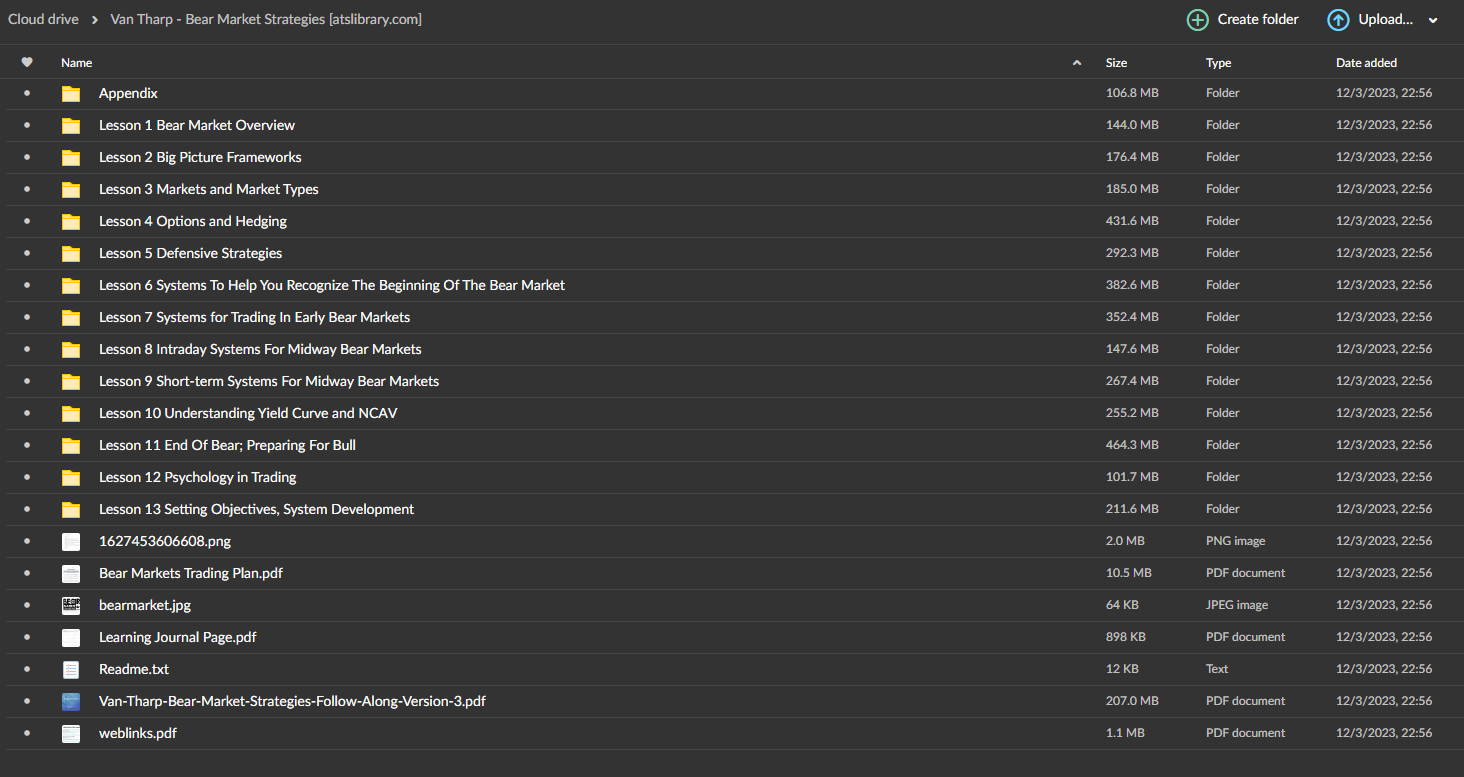

Bear Market Strategies eLearning Course

About Course:

The Objectives are to ensure you are prepared to prosper in the next bear market (or downturn).

Specifically, you will:

-

Study in-depth the concept of a bear market.

-

Learn what a bear market truly is and learn several ways to define and measure the bear market type.

-

Know when a bear market type might be starting and how to know when it might end.

-

Learn several different trading strategies suited for bear market conditions.

-

Learn how options and hedging can be especially useful for bear market types.

This home study course will help you:

-

Outline a big picture view of bear markets and where we may be now – from a big picture, historic viewpoint.

-

Identify and define bear markets using various methodologies.

-

Understand the psychology of bear markets and the personal psychology required for you to benefit from them

-

Study first-hand trading experiences of bear markets from 1987;1998; 2000; 2008; Japan’s lost decade in the 90s, Oil, 2014-2015

-

Understand basic options strategies useful in bear markets

-

Understand some basic hedging strategies

-

Understand how to be prepared to trade bear markets

-

Create a Systems development process plan

-

Outline your objectives for bear markets

-

Create Position Sizing Strategies for bear markets

This home study helps you learn how to think about trading broad bear markets or trading a specific asset class, sector or even single symbol that is in bear mode. For a major bear market, think equities in 2008-2009. For a move limited to a sector move, think oil in 2014-2015. Imagine having had some ways you could have traded those periods effectively.

Major bear markets come only once in a while but “lesser” down moves can be found almost anytime — including during bull markets. Start using the information from this course — and be prepared for the next bear market move.

Are you prepared for the next bear market?

Over 1.000 comments

Over 1.000 comments