The course includes:

- The relevant building blocks for high-frequency trading: DOM/order flow + volume

- Stops and profit targeting based on the order book

- How you trade with the “Big Boys”

- Systematic trading

- Market manipulations

- Identify HFT algorithms

- Market Making

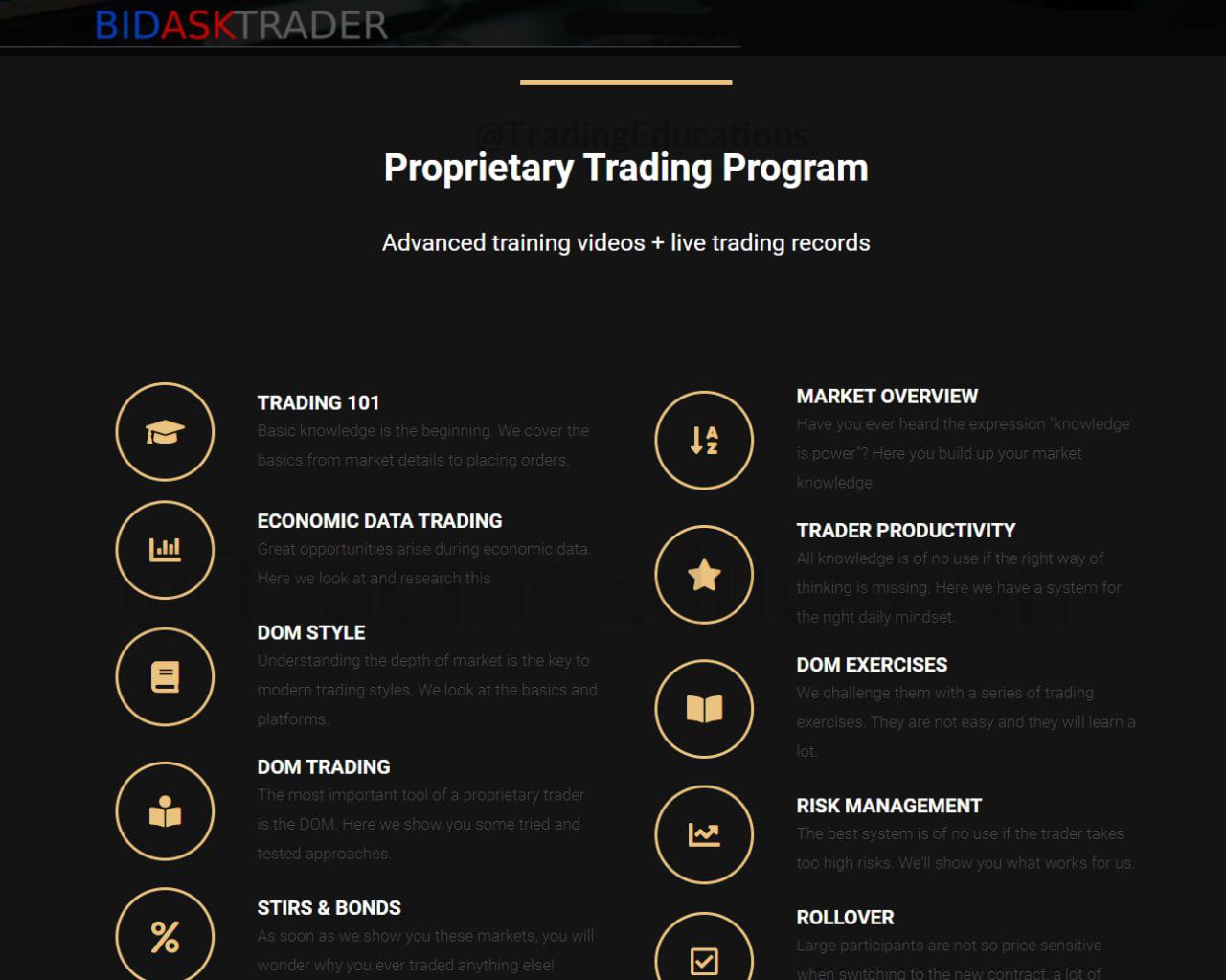

PROPRIETARY TRADING PROGRAM

Advanced training videos + live trading recordings

TRADING 101

Basic knowledge is the beginning. We cover the basics from market details to order placement.

TRADE ECONOMIC DATA

Big opportunities arise during economic data. Here we look at and explore this.

DOM STYLE

Understanding the Depth of Market is key to modern trading styles. We look at the basics and platforms.

DOM TRADING

The most important tool of a proprietary trader is the DOM. Here we show you some tried and tested approaches.

STIRS & BONDS

As soon as we show you these markets you will wonder why you have ever traded anything else!

TECHNICAL ANALYSIS

Technical analysis is very subjective and full of bullshit, here we are going to show you the useful things.

MARKET OVERVIEW

Have you ever heard the phrase “knowledge is power”? This is where you build up your market knowledge.

TRADER’S PRODUCTIVITY

All knowledge is useless if the right way of thinking is missing. Here we have a system for correct daily thinking.

DOM EXERCISES

We challenge them with a series of trading exercises. They are not easy and they will learn a lot.

RISK MANAGEMENT

The best system is of no use if the trader takes on too high a risk. We’ll show you what works for us.

ROLLOVER

Large participants are not so price sensitive when switching to the new contract, a lot of money falls by the wayside.

MARKET MAKING

Market making and other non-directional trading styles are the proprietary trader’s tools.

Professional order book trading

Master the order book!

After the amazing feedback from my test participants, I decided to offer an advanced course for everyone who is interested in learning order book trading.

The goal of this program is to help new traders read the order book, how to spot buyers / sellers, and how to build strategies on them. Above all, I want to show how a professional trader acts, which is why you should understand after the course how nonsensical most of the stuff on the Internet is and how important it is to trade with the order book and why all prop traders trade with it.

Hopefully the course will open your eyes. The course includes:

- The relevant building blocks for high-frequency trading: DOM / order flow + volume

- Stops and profit target based on the order book

- How you are trending with the “Big Boys”

- Systematic trading

- Market manipulations

- Identify HFT algorithms

- Market making

and much more …

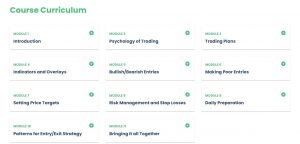

What you will be able to do after this course

PART 1

- You know how the market works

- You can read the volume profile

- You know how to read the order book

- You can spot buyers and sellers

- You trade according to functioning, professional trading setups

- You can identify large market participants based on the order book

PART 2

- You can identify turning points in the market just through the order book

- You use correlating markets

- You use the VWAP to your advantage

- You can trade anything: breakouts / reversals

- Fake Bids & Offers: You know which orders are real

- You understand the importance of ups & downs

PART 3-4

- You know your trade management

- You can find opportunities with good CRV

- You know how to prepare for the day

- You know how Support & Resistance / Volume Profiles really work

- You know your trading hours

- You understand how to gain an advantage

- and much more…

FREE TRAINING

For my advanced course, I assume that you have worked through my free course at least once. Please work it through beforehand.

Over 1.000 comments

Over 1.000 comments