-

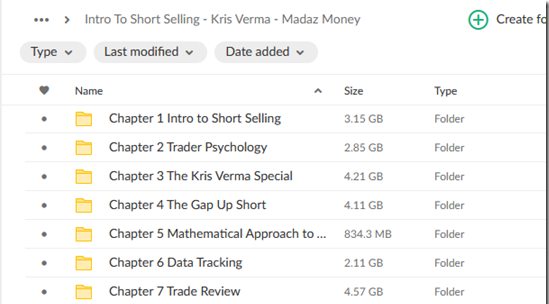

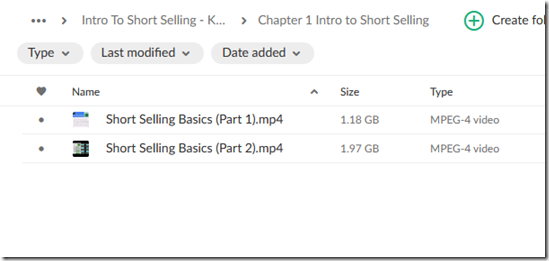

Master the basics of short selling (brokers, trading setups, borrowing shares, order entry, etc.)

-

Learn A+ setups, including the Kris Verma Special and the Gap Up Short

-

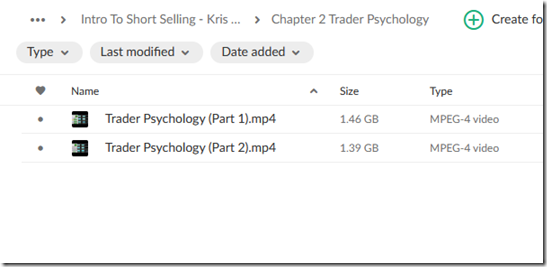

Understand trader psychology and how to control your emotions

-

Learn how to exponentially grow your account utilizing the power of compounding and the Kelly criteria

-

Learn adequate risk management

-

Learn how to utilize statistical monitoring and Excel spreadsheets to identify opportunities.

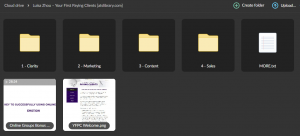

Jon Sinn – Chase Formula

Jon Sinn – Chase Formula

Lana Sova – Rapid Email Mastery Course

Lana Sova – Rapid Email Mastery Course

Intro To Short Selling – Kris Verma – Madaz Money

Original price was: $2,990.00.$50.00Current price is: $50.00.

-98%Price in official website: 2990$

We offer in just : 50$

Product Delivery : You will receive download link in mail or you can find your all purchased courses under My Account/Downloads menu.

Over 1.000 comments

Over 1.000 comments