Jayson Casper’s Scalp Trading Mini Course: Unlock Profits

Are you ready to take your trading skills to the next level? Look no further than Jayson Casper’s Scalp Trading Mini Course. As an experienced trader myself, I can confidently say that this course is a game-changer. Whether you’re a beginner looking to dip your toes into the world of scalp trading or an experienced trader wanting to refine your skills, this course has something for everyone.

With Jayson Casper as your guide, you’ll learn the ins and outs of scalp trading, a rapid trading strategy that focuses on making quick profits from small price movements. Jayson’s expertise and years of experience in the market make him the perfect mentor to teach you the secrets of successful scalp trading. From identifying the best entry and exit points to managing risk effectively, Jayson covers it all in this comprehensive mini course.

Don’t miss out on this opportunity to learn from one of the best in the industry. Join Jayson Casper’s Scalp Trading Mini Course today and take your trading skills to new heights.

What is Scalp Trading?

Scalp trading is a trading strategy that focuses on making quick profits from small price movements in the financial markets. It is a popular approach among active traders who seek to capitalize on short-term market fluctuations.

In scalp trading, the goal is to enter and exit trades rapidly, often within minutes or even seconds, to take advantage of small price movements. Traders who employ this strategy typically aim for small, frequent wins, rather than waiting for larger trends to develop.

Scalp traders use various technical indicators, charts, and market data to identify entry and exit points. They often rely on tools such as Level II market data, which provides a real-time view of bid and ask prices, to determine the most favorable prices to buy or sell.

This strategy requires traders to stay focused and make decisions quickly. It also requires strict risk management, as the potential for losses can be higher when aiming for small gains. Effective risk management techniques, such as setting stop-loss orders, are crucial for scalping.

The Scalp Trading Mini Course by Jayson Casper is designed to teach participants the ins and outs of scalp trading. From understanding market dynamics to identifying profitable setups, the course covers everything traders need to know to succeed in this rapid trading strategy.

Benefits of Scalp Trading

Scalp trading offers a range of benefits for traders who are looking to capitalize on small price movements in the financial markets. As someone who has been trading for years, I can confidently say that scalp trading can be a highly profitable strategy when executed effectively. Here are some key benefits of scalp trading:

- Quick Profits: One of the main advantages of scalp trading is the potential to make quick profits. By focusing on short-term price fluctuations, scalp traders are able to enter and exit trades rapidly, often within minutes or even seconds. This allows them to take advantage of small price movements and generate profits on a regular basis.

- Reduced Risk Exposure: Scalp trading typically involves smaller position sizes, which helps to minimize risk exposure. Since scalp traders are aiming for small price movements, they can afford to trade larger quantities of shares or contracts without risking a significant portion of their capital. This allows for better risk management and the ability to navigate volatile market conditions more effectively.

- Increased Trading Opportunities: Another benefit of scalp trading is the abundance of trading opportunities available. Because scalp traders are constantly monitoring the markets for small price fluctuations, they have a higher frequency of trades compared to other trading strategies. This means more opportunities to profit from the market and potentially increase overall trading gains.

- Lower Emotional Stress: Unlike long-term trading strategies that require patience and discipline, scalp trading allows for quick decision making and minimizes emotional stress. Since trades are executed and closed within short timeframes, scalp traders do not have to deal with prolonged market fluctuations or worrying about overnight market movements. This can result in a more relaxed and focused trading experience.

To conclude, scalp trading offers several benefits including the potential for quick profits, reduced risk exposure, increased trading opportunities, and lower emotional stress. But, it’s important to note that scalp trading requires a certain level of skill, experience, and discipline. As mentioned earlier, I highly recommend the Scalp Trading Mini Course by Jayson Casper as a comprehensive resource for learning about scalp trading and succeeding in this rapid trading strategy.

About Jayson Casper

Jayson Casper is a highly regarded expert in the field of scalp trading. With years of experience in the financial markets, Jayson has developed a deep understanding of this rapid trading strategy.

His expertise and knowledge have led him to create the Scalp Trading Mini Course, a comprehensive resource designed to help traders learn the ins and outs of scalp trading and succeed in this rapid market.

Through his course, Jayson shares his proven strategies, techniques, and insights to help traders capitalize on small price movements and maximize their profits. He emphasizes the importance of skill, experience, and discipline in executing this strategy effectively.

Jayson’s approach to scalp trading is based on a solid foundation of research and analysis. He understands that successful scalp trading requires a deep understanding of market trends, technical indicators, and risk management.

What sets Jayson apart is his ability to explain complex concepts in a clear and concise manner. His teaching style is engaging and easy to follow, making the Scalp Trading Mini Course suitable for traders of all levels, from beginners to experienced professionals.

For anyone looking to enhance their trading skills and take advantage of small price movements in the financial markets, Jayson Casper’s Scalp Trading Mini Course is a must-have resource.

So, if you’re ready to jump into the world of scalp trading and unlock the potential for quick profits, reduced risk exposure, increased trading opportunities, and lower emotional stress, I highly recommend checking out Jayson Casper’s Scalp Trading Mini Course.

Course Overview

##Course Overview

When it comes to trading, staying ahead of the game is key. That’s why I’m thrilled to introduce you to the Scalp Trading Mini Course by Jayson Casper. This comprehensive resource is designed to help traders of all levels enhance their skills and take advantage of small price movements in the market.

In this Scalp Trading Mini Course, you’ll gain access to a wealth of knowledge and insights from Jayson Casper, a highly regarded expert in scalp trading. Jayson shares his proven strategies and techniques, accumulated through years of experience, to help you capitalize on quick profits and maximize your trading opportunities.

What sets this course apart is Jayson’s engaging teaching style. He breaks down complex concepts in a way that is easy to follow, making it suitable for both beginner and experienced traders alike. With Jayson’s guidance, you’ll learn how to reduce risk exposure, increase trading opportunities, and lower emotional stress.

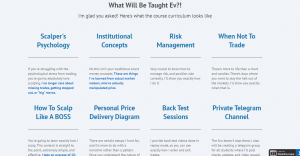

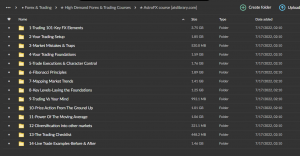

The Scalp Trading Mini Course covers a wide range of topics, including:

- Introduction to scalp trading

- Identifying favorable market conditions

- Analyzing price charts and indicators

- Executing trades with precision

- Managing risk effectively

Whether you’re new to the world of trading or you’re a seasoned trader looking to refine your skills, the Scalp Trading Mini Course is a must-have resource. It provides you with the tools and knowledge you need to succeed in the rapid world of scalp trading.

Important Concepts in Scalp Trading

Scalp trading is a rapid strategy that requires a solid understanding of specific concepts to be successful. Here are some key concepts to keep in mind when practicing scalp trading:

- Timeframes: In scalp trading, traders focus on short-term price movements. This means they analyze price action on smaller timeframes, such as one-minute or five-minute charts, to identify quick profit opportunities. It’s crucial to have a good grasp of these shorter timeframes and how price behaves within them.

- Volatility: Volatility refers to the magnitude of price fluctuations in the market. Scalp traders thrive on volatile markets, as it provides them with more frequent trading opportunities. But, it’s important to understand how to manage risk effectively in highly volatile conditions.

- Liquidity: Liquidity refers to the ease with which an asset can be bought or sold without causing significant price changes. Scalp traders aim to trade in highly liquid markets to ensure efficient execution of their trades and minimize slippage.

- Chart Patterns: Mastering chart patterns is essential for scalp traders. They look for specific patterns, such as triangles, flags, or double tops/bottoms, to identify potential entry and exit points. Recognizing these patterns quickly and accurately is a valuable skill in scalp trading.

- Tight Stop Losses: Scalp traders typically use tight stop losses to limit their risk on each trade. This means having a predetermined point at which they will exit the trade if the price moves against them. Setting tight stop losses and sticking to them helps protect capital and manage risk.

- Risk-to-Reward Ratio: The risk-to-reward ratio is the amount of risk taken in a trade compared to the potential profit. Scalp traders often look for trades with a favorable risk-to-reward ratio, aiming to take small, manageable risks for the potential of larger rewards.

By understanding these important concepts in scalp trading, traders can make informed decisions and execute trades with precision. Remember, practice and experience are key to mastering scalp trading techniques and achieving consistent profitability.

Strategies for Scalp Trading

As I mentioned earlier, scalp trading involves capitalizing on small price movements in the financial markets. To be successful in this strategy, you need to have a solid set of strategies in place. Here are a few effective strategies for scalp trading:

- Trend following: One popular strategy is to follow the trend. When the market is trending upwards, you can look for opportunities to go long, and when the market is trending downwards, you can look for opportunities to go short. By following the trend, you increase your chances of catching profitable trades.

- Breakout trading: Another strategy is to trade breakouts. Breakouts occur when the price breaks through a significant level of support or resistance. When a breakout happens, it indicates a strong momentum in one direction, and you can look for opportunities to enter trades in that direction.

- Range trading: Range trading involves identifying periods of consolidation or sideways movement in the market. During these periods, the price tends to move between a support and a resistance level. Traders can look for opportunities to buy at the support level and sell at the resistance level, taking advantage of the price’s range-bound behavior.

- Scalp trading with indicators: Indicators can be powerful tools in scalp trading. They help traders identify potential entry and exit points based on specific mathematical calculations. Some popular indicators used in scalp trading include moving averages, stochastic oscillators, and Bollinger Bands. These indicators provide valuable insights into market conditions and can help traders make informed trading decisions.

It’s important to note that these strategies are just a starting point, and you should adapt them to your own trading style and preferences. Scalp trading requires practice, experience, and constant learning. By honing your skills and refining your strategies, you can increase your chances of success in this rapid trading approach.

Remember, mastering scalp trading techniques takes time and dedication. The Scalp Trading Mini Course offered by Jayson Casper is a valuable resource that can provide you with the knowledge and insights you need to excel in this strategy.

Analyzing Charts and Indicators

When it comes to scalp trading, analyzing charts and using indicators is crucial for making informed decisions and executing trades with precision. In the Scalp Trading Mini Course, I provide comprehensive insights and strategies on how to effectively analyze charts and indicators. Here are some key points to consider:

- Chart Patterns: Chart patterns can provide valuable information about price movements and potential trading opportunities. Chart patterns such as triangles, double tops, and head and shoulders can indicate trend reversals or continuation patterns. By understanding these patterns, traders can make more accurate predictions and identify entry and exit points.

- Moving Averages: Moving averages help traders identify trends and smooth out price fluctuations. By calculating the average price over a specific period of time, moving averages can provide indications of support and resistance levels. Traders can use different periods of moving averages (e.g., 50-day, 200-day) to analyze short-term and long-term trends.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It can indicate whether a market is overbought or oversold, helping traders identify potential reversals. A reading above 70 suggests overbought conditions, while a reading below 30 suggests oversold conditions.

- Bollinger Bands: Bollinger Bands consist of a moving average and two standard deviation bands. They help traders identify volatility and potential price breakouts. When the price moves close to the upper band, it may indicate overbought conditions. Conversely, when the price moves close to the lower band, it may indicate oversold conditions.

- Volume Analysis: Analyzing trading volume can provide insights into market participation and potential price reversals. Higher volume during price increases may indicate buying pressure, while higher volume during price decreases may indicate selling pressure. Volume analysis can help confirm or reject potential trade setups.

When analyzing charts and indicators, it’s important to remember, no single indicator can guarantee success. Traders should use a combination of indicators and consider multiple timeframes for a comprehensive analysis. Experimentation and practice are essential to find the indicators and chart patterns that work best for your trading style.

The Scalp Trading Mini Course dives deeper into analyzing charts and indicators, providing real-life examples and practical tips to enhance your scalp trading skills.

Risk Management in Scalp Trading

In scalp trading, effective risk management is crucial for success. As a high-paced trading strategy that capitalizes on small price movements, it is important to have a structured approach to manage risk and protect your capital. Here are some key considerations for risk management in scalp trading:

- Position Sizing: Determining the appropriate size for each trade is essential. By allocating a small percentage of your capital to each trade, you limit the potential loss and protect against significant drawdowns.

- Setting Stop Loss Orders: Placing tight stop loss orders is vital in scalp trading. This allows you to exit a trade quickly if the market moves against you. Stop loss orders should be based on technical levels, such as support and resistance, to ensure you cut losses early.

- Calculating Risk-to-Reward Ratio: Before entering a trade, it is important to assess the potential reward in relation to the risk. Aim for trades with a positive risk-to-reward ratio, where the potential profit is higher than the potential loss. This helps you ensure that the potential reward justifies the risk taken.

- Managing Emotions: Emotions can have a significant impact on trading decisions, leading to impulsive actions and poor risk management. Maintain discipline and stick to your trading plan, regardless of market fluctuations. Implementing solid risk management techniques allows you to trade with a clear mind and make rational decisions.

It’s important to note that risk management is not a one-size-fits-all approach. Each trader will have their own risk tolerance and preferred methods of managing risk. The key is to find a strategy that suits your trading style and helps you protect your capital while maximizing potential profits. Mastering risk management techniques takes time and practice, and the Scalp Trading Mini Course can provide valuable insights and strategies to enhance your risk management skills.

Remember, in scalp trading, managing risk effectively is just as important as identifying profitable opportunities. By implementing sound risk management techniques, you can increase your chances of long-term success in this rapid trading strategy.

Common Mistakes to Avoid

One of the keys to success in scalp trading is avoiding common mistakes that can negatively impact your trading results. Here are some mistakes to watch out for:

- Lack of Patience: Impatience can lead to impulsive trades and poor decision-making. It’s important to wait for the right opportunities and not jump into trades too quickly.

- Ignoring Risk Management: Proper risk management is essential in scalp trading. Failing to set stop loss orders or not calculating the risk-to-reward ratio can expose you to unnecessary losses.

- Overtrading: Overtrading can result in burnout and diminish your profitability. It’s important to stick to your trading plan and not get caught up in the excitement of constant trading.

- Not Adapting to Market Conditions: Market conditions can change quickly, and it’s important to adapt your trading strategy accordingly. Failing to do so can lead to missed opportunities or losses.

- Relying Too Much on Indicators: While indicators can be useful, relying solely on them can result in missed opportunities or false signals. It’s important to use indicators as a tool along with other forms of analysis.

- Letting Emotions Control Your Decisions: Emotional trading can cloud judgment and lead to impulsive decisions. It’s important to stay disciplined and stick to your trading plan, regardless of market fluctuations.

By being aware of these common mistakes and actively avoiding them, you can improve your scalp trading results and increase your chances of success. Remember, scalp trading takes time and effort to master, but with the right approach, it can be a profitable strategy. Keep learning, practicing, and refining your skills, and you’ll be on your way to becoming a successful scalp trader.

Conclusion

In this text, I have discussed the benefits of scalp trading as a strategy for capitalizing on small price movements in the financial markets. Scalp trading offers numerous advantages, including the potential for quick profits, reduced risk exposure, increased trading opportunities, and lower emotional stress. It requires skill, experience, and discipline to execute this strategy effectively.

To help traders learn and succeed in scalp trading, Jayson Casper has created the Scalp Trading Mini Course. This comprehensive resource covers a wide range of topics, including an introduction to scalp trading, identifying favorable market conditions, executing trades with precision, and managing risk effectively. Jayson shares his proven strategies, techniques, and insights to help traders capitalize on small price movements and maximize their profits.

Throughout the article, I have introduced important concepts in scalp trading, such as timeframes, volatility, liquidity, chart patterns, tight stop losses, and risk-to-reward ratio. I have also provided additional strategies for scalp trading, including trend following, breakout trading, range trading, and using indicators. It is essential to adapt these strategies to one’s own trading style and preferences.

Analyzing charts and indicators is crucial in scalp trading. I have provided insights into chart patterns, moving averages, relative strength index (RSI), Bollinger Bands, and volume analysis. It is important to use a combination of indicators and consider multiple timeframes for a comprehensive analysis.

Risk management is a key aspect of scalp trading. I have highlighted the importance of position

Frequently Asked Questions

What is scalp trading?

Scalp trading is a trading strategy that aims to capitalize on small price movements in the financial markets. Traders execute multiple trades in a short period to generate quick profits.

What are the benefits of scalp trading?

Scalp trading offers several benefits, including reduced risk exposure, increased trading opportunities, lower emotional stress, and the potential for quick profits.

What is the Scalp Trading Mini Course?

The Scalp Trading Mini Course is a comprehensive resource designed to help traders learn and succeed in scalp trading. It covers various topics, including an introduction to scalp trading, identifying favorable market conditions, executing trades with precision, and managing risk effectively.

What are some important concepts in scalp trading?

Important concepts in scalp trading include timeframes, volatility, liquidity, chart patterns, tight stop losses, and risk-to-reward ratio. Understanding these concepts is crucial for making informed decisions and executing trades with precision.

What are some strategies for scalp trading?

Some strategies for scalp trading include trend following, breakout trading, range trading, and using indicators. It is important to adapt these strategies to one’s own trading style and preferences.

How do you analyze charts and indicators in scalp trading?

Analyzing charts and indicators in scalp trading involves studying chart patterns, moving averages, relative strength index (RSI), Bollinger Bands, and volume analysis. It is recommended to use a combination of indicators and consider multiple timeframes for a comprehensive analysis.

What is the importance of risk management in scalp trading?

Risk management is crucial in scalp trading. It involves position sizing, setting stop loss orders, calculating risk-to-reward ratio, and managing emotions. Finding a risk management strategy that suits one’s trading style and preferences is essential.

What are some common mistakes to avoid in scalp trading?

Common mistakes to avoid in scalp trading include lack of patience, ignoring risk management, overtrading, not adapting to market conditions, relying too much on indicators, and letting emotions control decisions. Being aware of these mistakes and actively avoiding them can improve trading results.

Over 1.000 comments

Over 1.000 comments