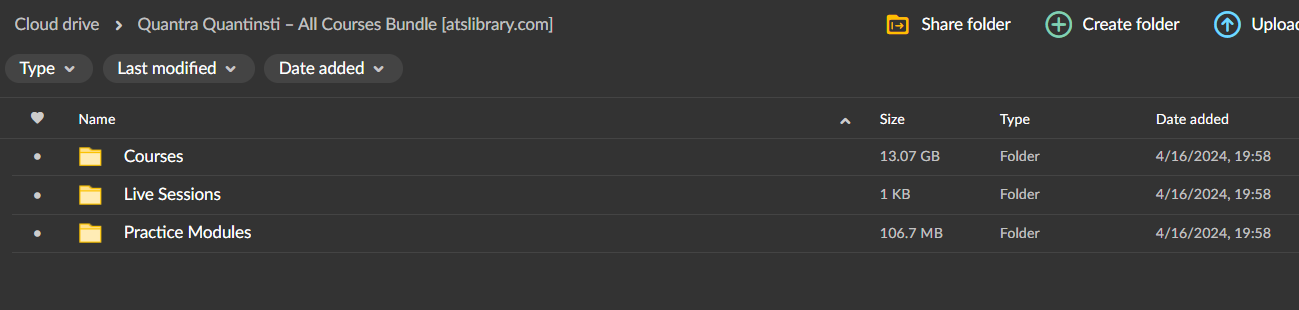

About Courses

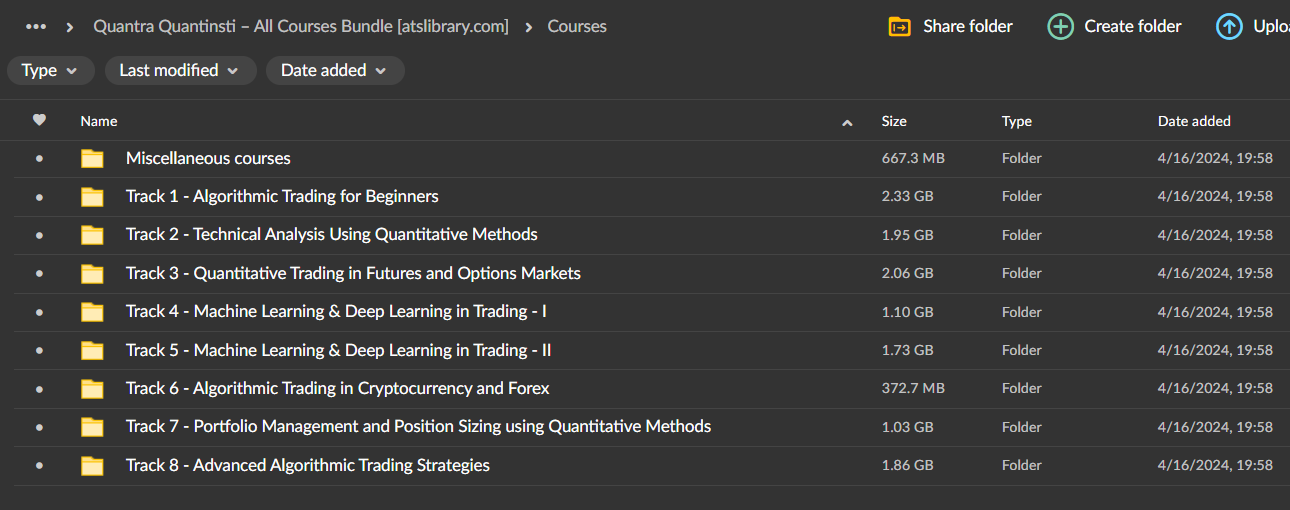

Track 1 : Algorithmic Trading For Beginners

Use 25+ strategies like Intraday Trading, Machine Learning, and Quant techniques to optimize your trading portfolio.

Track 2 : Technical Analysis Using Quantitative Methods

Technical indicators and candlesticks, sentiment trading, swing trading, volatility trading and backtesting.

Track 3 : Quantitative Trading In Futures And Options Markets

Options pricing models and strategies such as gamma scalping, dispersion and delta hedging diversified futures trading strategies.

Track 4 : Machine Learning & Deep Learning In Trading – I

From data cleaning aspects to optimising AI models, learn how to create your prediction algorithms using classification and regression techniques.

Track 5 : Machine Learning & Deep Learning In Trading – Ii

Step-wise training on the complete lifecycle of trading strategies and portfolio management using machine learning. Learn from experts!

Track 6 : Algorithmic Trading In Cryptocurrency And Forex

8+ strategies such as Ichimoku Cloud, Aroon Indicator, unsupervised learning and pairs trading to trade cryptocurrencies & FX markets effectively.

Track 7 : Portfolio Management And Position Sizing Using Quantitative Methods

Apply effective position sizing techniques and optimise your portfolio. Include machine learning to gain a competitive edge.

Track 8 : Advanced Algorithmic Trading Strategies

A series of courses where you will learn more than 18+ new strategies such as mean-reversion, index arbitrage, long-short, breakout, ARIMA, GARCH

WHY GO FOR ALL COURSES ?

Highest Possible Savings

Unlock huge savings with our highest possible discount rate and zero cost EMI options!

Rare & One-of-a-kind

Immerse in unique and exclusive set of quant trading courses, tailored for your success

Diverse Learning Content

Learn trading strategies, machine learning, options trading, portfolio management.

Comprehensive Skill Development

Develop a solid foundation in quant trading, covering essential concepts, strategies, and tools

8 LEARNING TRACKS | 50+ COURSES

WHY GO FOR ALL COURSES ?

Unlock huge savings with our highest possible discount rate!

Immerse in unique and exclusive set of quant trading courses, tailored for your success

Learn trading strategies, machine learning, options trading, portfolio management & live trading

Develop a solid foundation in quant trading, covering essential concepts, strategies, and tools

COURSES IN CART

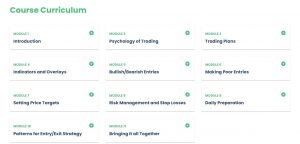

Getting Started with Algorithmic Trading!

Over 1.000 comments

Over 1.000 comments