What You Get:

Thousands of Hours of Insight — Delivered in Less Than 10

Make yourself a more secure investor by learning from the top.

The process of becoming a better investor an ongoing journey. It’s not an easy one. You need to learn from the world’s top investors, without blindly copying them.

It is essential to apply theories learned in the classroom in real life (always difficult). It is important to stay clear of scammers (increasingly difficult). You must avoid information and data-related stagnation.

Urgh.

The reason for all this is that we created The Real The Investing Course.

- It’s game-changing, providing information you can’t get in any other sourcefrom hundreds of experienced investors.

- It’s super-charged, distilling thousands of hours of informationand giving the information to you in less than 10 minutes.

- It’s stock, lock and barrel Real Vision acquired and built on top of the Lex van Dam Trading Academy as an blockbuster course in investingbased around the frameworks that were developed at one of the best London trade desks.

Oh you should don’t forget boring PowerPoint presentations that are presented by a person wearing an oversized shirt…

The Real Investing Course is filmed in an underground bunker, a cinema and a bar, which means you’ll know that it’s never boring…

Access a Single Source of Learning That Brings It ALL Together

It’s not going to transform you into George Soros overnight. It can help you become an even more independent and successful investor. Here’s how:

After you have enrolled in The Real Investment Course, we’ll guide participants through our course the Manifesto and a nine-minute guide on How to Navigate This journey. After that, it’s time to begin the The course’s syllabus.

The Game of Investing

It’s easy for people to think that it’s a good idea to think that the Game of Investing is rigged or that the markets (or the players) are trying to screw your head. In reality, it’s about evaluating inputs of data to create money-making investment opportunities. Simple(!)

This three-lesson course focuses on the game’s larger scope as well as its basic rules, and a few principles to guide you through the field including the players, as well as their mistakes.

What You’ll Learn:

- How do you determine the best way to determine your individual investment way of investing rather than relying on other investors

- The reason why the concept of “Mr. Market” is B.S. (and so is the notion of investing as a “holy holy”)

- The first step you should take to beat the challenge of investing

- The four most important market realities you must write on your Post-It on your desktop

- How can you evaluate your five kinds of capital’ (not just your financial capital)

- How do I utilize contextual information to limit the abyss of information we’re bombarded by daily

- And much more

At the End You Will:

Be a more conscious emotional invest… Find out (or verify) your investment style… Keep track of your diet of information carefully.

The Stuff That Drives Markets

Market drivers are a type of Russian doll’s world, featuring several trends from different time frames that are co-existing at any given moment in time.

This lesson, which spans seven modules, will provide you with an understanding of co-existing (and seeming to be conflicting) trends. Because when the trends aren’t clear to you, you’ll be out of the loop with what you have in your portfolio…

What You’ll Learn:

- The three large types that market participants are in.

- What exactly are you supposed to combine various typesies in market-driven drivers within one portfolio?

- The reason you should gain edge over your competition by discovering the trend within the trend

- The relation among central banks as well as market participants

- How do you keep track of multiple time perspectives simultaneously?

- How do you determine and monitor markets drivers yourself

At the End You Will:

Learn about the market’s ecosystem driver… Learn how to monitor market drivers for yourself… You can test your portfolio using your newly acquired insights into market drivers.

The Art (& Science) of Charts

As with all tools used in investing charts, they must be handled with care and in a professional manner in order to aid you in stacking the odds in your favor and manage risk in a way that you are able to keep playing the game.

This six-lesson module is focused on the importance of charts as tools to be used by everyone in their framework.

What You’ll Learn:

- The reason charts serve as the “best friend and worst enemy all at once”

- Charts that can help sort concepts and get a lot of information at a glance

- The most common mistakesinvestors commit when they use charts

- The reason why charts can in no way reliable predictors for the near future

- How to recognize trends, important resistance, support levels and more

- A few popular chart patterns include pennants flags, triangles, and pennants

- And much more

At the End You Will:

Learn the the common patterns of charts… Be aware of how to avoid the “gotchas” of relying too heavily in chart patterns… Prepare to utilize charts to guide your investment decision-making.

The Asset Class Universe

The main asset class universe is comprised of fixed income, equities commodities, currencies, as well as digital asset.

This seven-lesson course focuses on learning about the universe (and the most important thing the way that the planets in the universe work together).

What You’ll Learn:

- What are the common driving factors for the asset price performance

- Top-down structureto be able to comprehend and manage the entire asset class universe

- The reason Bonds are less frightening than they might initially appear

- How do I discover the connections between commodities, fixed income currency, digital assets

- How do you apply fundamentals of asset classes in your investment

- Plus

At the End You Will:

Learn about the different players within the asset class world… Be aware of the relationship between the participants… You should feel at ease in constructing hypotheses on these connections.

The Science (& Art) of Building a Portfolio

You’ll now have a the foundation of charts as well as investment the psychology of asset classes and market factors.

This six-lesson course will cover the whole process of managing portfolios beginning with the expression of one trade idea to creating a comprehensive portfolio that meets your needs.

What You’ll Learn:

- It is the gold rulesof managing risk

- The difficult task of knowing the correlations in your portfolio

- How do you think about and manage the risk of liquidity, volatility as well as leverage

- The reason the need for risk management and portfolio creation may be the most important aspect of the entire investment process

- How to approach portfolio creation in light of your particular situation

- And much more

At the End You Will:

You will feel more comfortable creating and managing your personal portfolio… Learn to apply the “rules” for risk-management… You should be able to customize your portfolio by focusing on your own personal preferences rather than implementing an overall structure and trying to hope for the most optimal.

How You’ll Learn:

The course will help you help you improve your strategy for investing. Even if you’ve been doing it for a long time it will force you to re-examine and test your strategy as a trader needs to do.

Here’s how to approach each module:

- Then, we will cover the basic concepts and ideas that are applicable to each of the modules in Basics

- We then review the concepts and ideas in relaxed discussionwith Roger Hirst, Jamie McDonald and James Helliwell. In this episode, you’ll discover different details from three pros who look at markets in a different way

- Then, we will unlock insights from The Real Vision archives and learn from the Pros such as Raoul Pal, Chris Cole, Lyn Alden, Mark Ritchie II and Pierre Andurand.

- And then, Roger pulls it altogether through action-oriented Workshops with practical strategies, practical tasks and a variety of investing scenarios. It’s all real-world stuff.

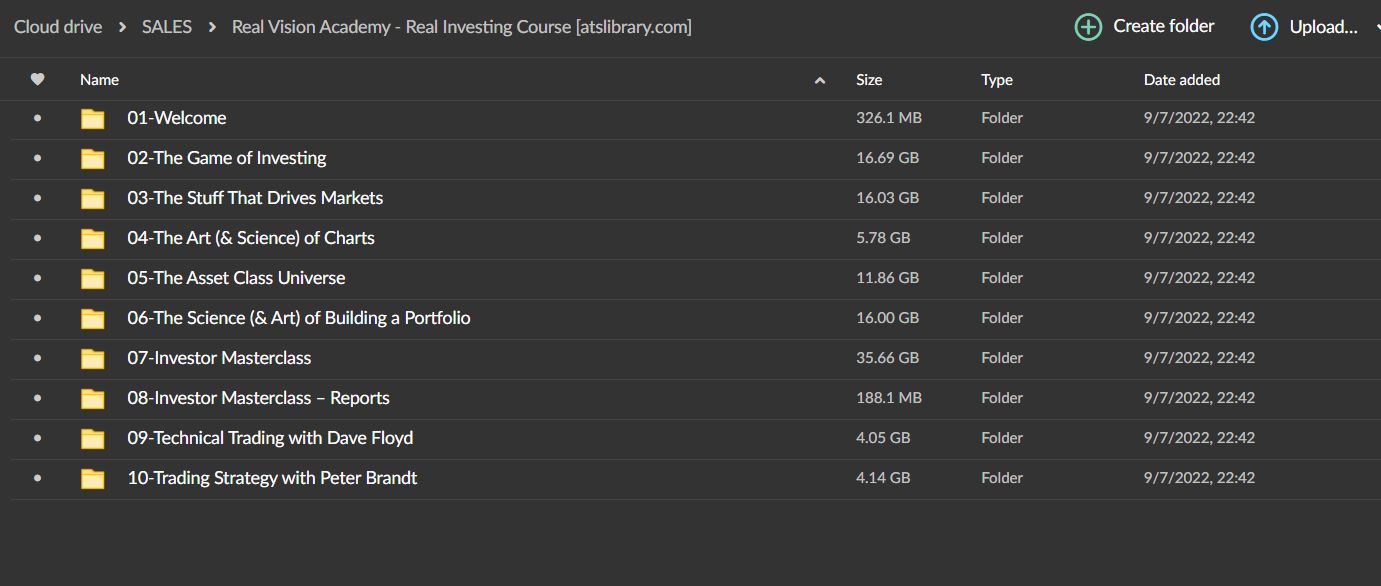

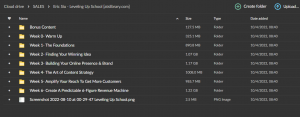

TOTAL SIZE: 110.72GB

Over 1.000 comments

Over 1.000 comments