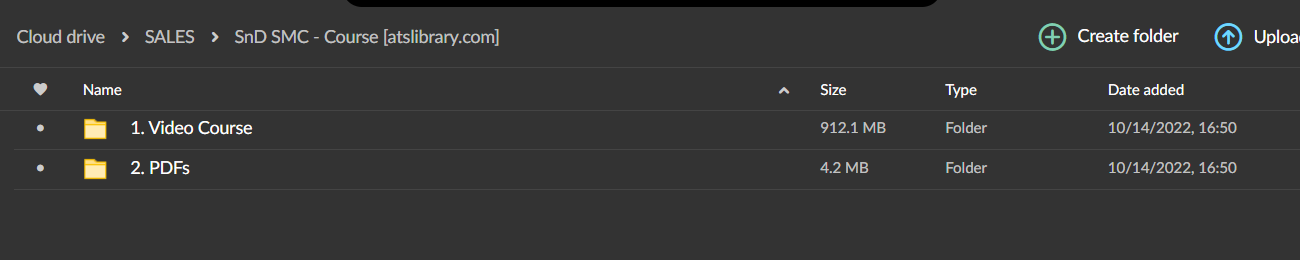

About Course:

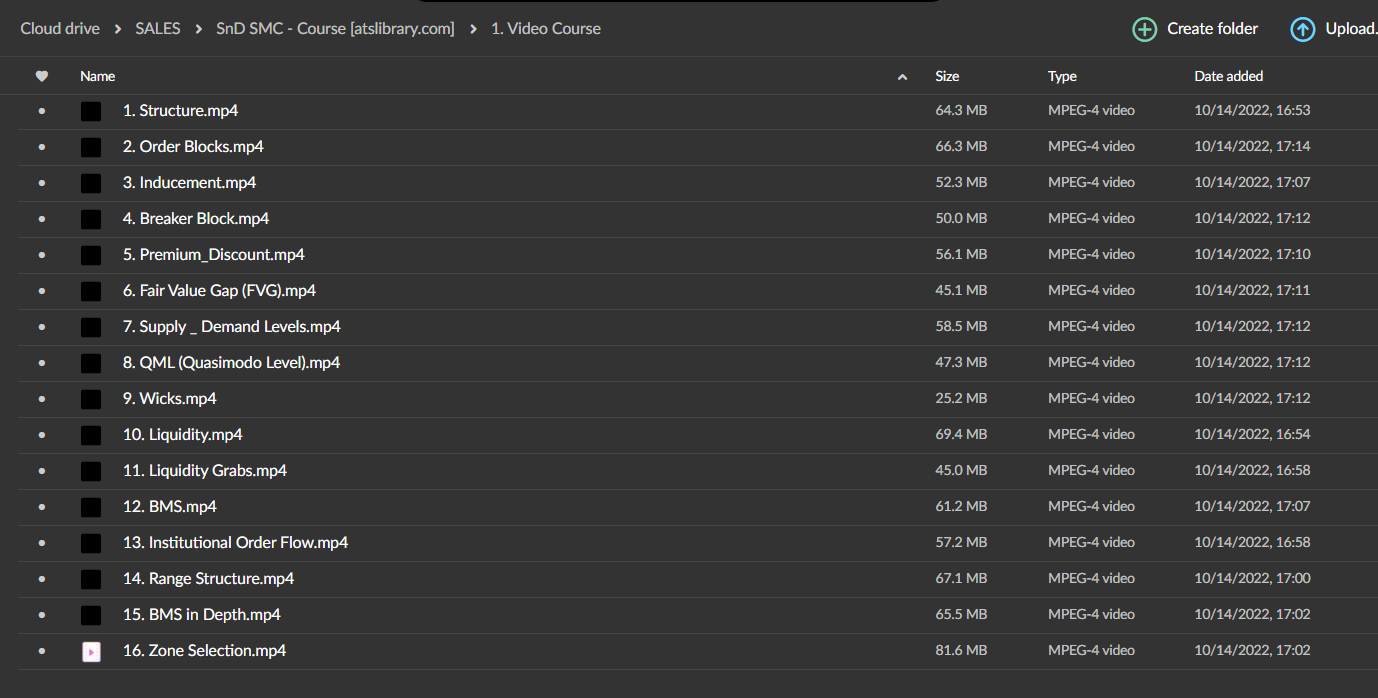

Lesson 1 – Structure

Market structure is very important. It is the behaviour, condition and current flow of the market. Highlighting swing highs and swing lows.

Lesson 2 – Order Blocks

The accumulation of orders from financial institutions and central banks. Used as special Supply & Demand zones.

Lesson 3 – Inducement

Inducement is a TRAP before an area of Supply or Demand. Luring impatient buyers/sellers into the market early, creating liquidity.

Lesson 4 – Breaker Candles

A reversal pattern formed when the market fails to make a Higher High / Lower Low.

Lesson 5 – Premium/Discount

When the exchange rate is higher than the spot exchange rate. Never should you BUY above 50% of a range nor SELL below 50% of a range.

Lesson 6 – Fair Value Gap (FVG)

It occurs when a candle fails to interlock another candle thereby causing an imbalance or insufficient pricing.

Lesson 7 – Supply/Demand

Located levels of buyers / sellers.

Lesson 8 – QML

Known as a reversal pattern after a significant move in the market. Price tends to retrace back to fill this void.

Lesson 9 – Wicks

Wicks are hidden candles.

Lesson 10 – Liquidity

Liquidity refers to how active a market is. Liquidity and Volatility are directly related. Remember, LIQUIDITY = MONEY.

Lesson 11 – Liquidity Grabs

Forcing market participants out of their positions. Also known as STOP HUNTS.

Lesson 12 – BMS

A very simple term used known as Break in Market Structure.

Lesson 13 – IOF (Institutional Order Flow)

Order Flow is accumulation of orders. In order flow, you look to follow the trend while using the Premium and Discount array mitigations.

Lesson 14 – Range Structure

Ranges are structure based. A range defines the difference between the highest and lowest prices traded. In a range, you look for buys / sells in Premium and Discount zones.

Lesson 15 – BMS (Break in market Structure) in Depth

A very simple term used known as Break in Market Structure, explained in depth.

Lesson 16 – Zone Selection

Minimising a buy/sell zone from multi-timeframe confluences to catch those SNIPER entries.

Over 1.000 comments

Over 1.000 comments