Netzero OptionsTM

Learn zero-based thinking, the 60-40-20 options trading strategy, and how to use Netzero OptionsTM to manage a portfolio of reliable options trading strategies.

This training course gives you:

- An options trading style that removes complexity to reveal a simple and elegant solution to generating high risk adjusted returns.

- The specific trading strategy that won the Top P/L spot in the 2016 SMB Options trading competition as well as the highest 12-month return on the SMB Options Desk.

- A new trading mentality that will change the way you think about options strategies.

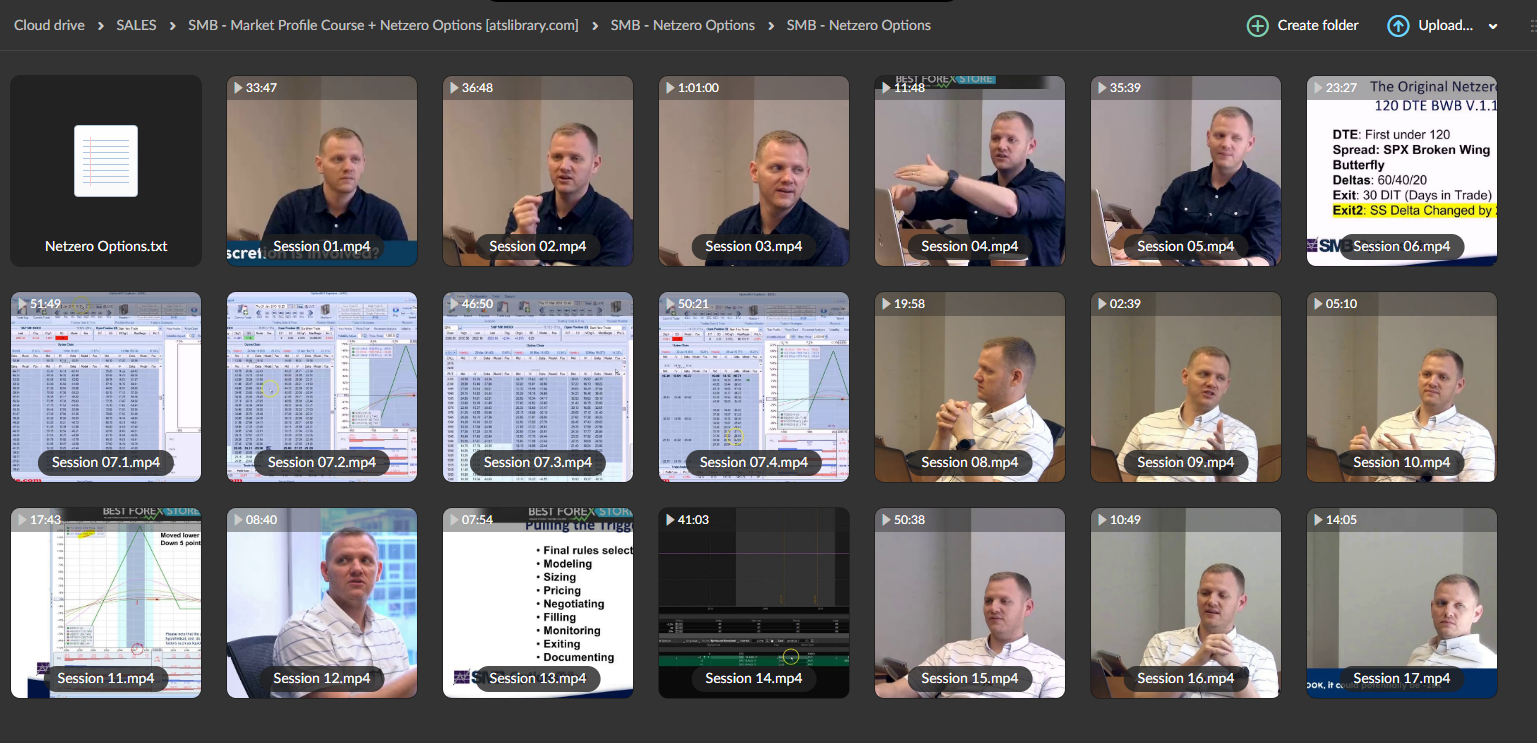

- A specific trading plan for the 60-40-20 Broken Wing Butterfly Netzero OptionsTMStrategy.

- The steps to construct your customized portfolio of Netzero OptionsTM trades.

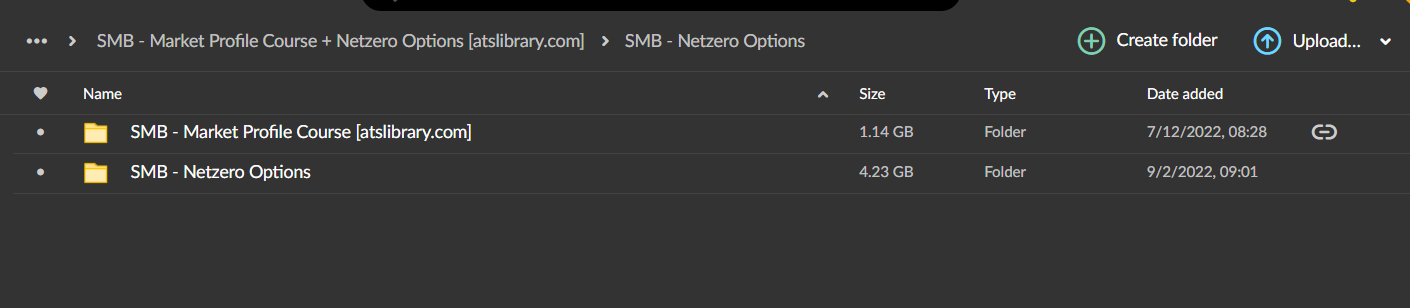

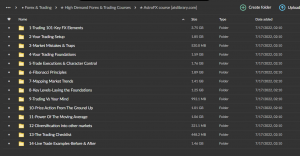

10+ Hour Course Outline

- Zero-based thinking in options trading

- Structural edge vs. strategic/directional edge

- Definitions and metrics in Netzero trades

- Where the edge comes from in Netzero trades

- Sizing principles

- Disconnecting emotions

- Basic structure of the first Netzero trade

- Greeks and software differences

- 60-40-20 overview

- Strict entry and exit rules

- Trade examples and long term back test results

- 3+ HOURS of Example Netzero Trades with Day-by-Day review and commentary

- Modifying strikes for Net Delta vs. Individual Deltas

- Modifying strikes for mean reversion edge

- Modifying strikes for Beta weighted portfolio net zero delta

- Sizing by risk

- Execution process

- Getting a fair price at entry and exit

- Differences between five figure and seven figure trades

- Reasons to perform additional back tests

- The steps to build your own succesful netzero trade

Over 1.000 comments

Over 1.000 comments